When we use currency, we calculate it to 2 decimal places. This is the cent value of our transaction. Sometimes because of the prices we use and the additional calculation of GST on these prices it is necessary to round these values to get a valid amount in terms of dollars and cents. This can sometimes have the effect of making invoices look like they don't add up. This is illustrated in the example below.

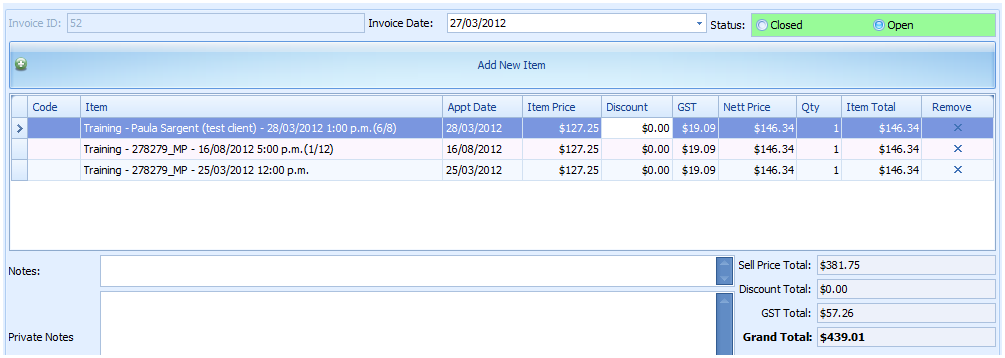

For example, Invoice # 52:

- Each item has a GST exclusive price of $127.25

- GST (at 15%) is calculated as $19.0875 and displayed on the invoice as $19.09

- This makes an items Nett Price of $127.25 + $19.0875 = $ 146.375. Displayed on the invoice as $146.34

- On this invoice there are three of the Training Items all priced at $127.25 so the Sell Price Total is $127.25 x 3 = $381.75

- The GST is displayed as $19.09; hence, it would appear that the GST would be $19.09 x 3 = $57.27

- But the actual GST Total calculation is $19.0875 x 3 = $57.2625 this rounds to the GST Total of $57.26 as shown on the invoice

- The Item Total calculation looks like it should be $146.34 x 3 = $439.02

- But, the actual Grand Total is $381.75 + $57.26 = $439.01 as shown on the invoice.

So, although the Grand Total appears to be out, it actually isn't.

The issue is that if the Invoice displayed is "forced" to add up, the GST will be wrong somewhere.

For example, if I make the GST Total = 3 x 19.09 (57.27) instead of 3 x 19.0875 (57.26). The invoice then looks correct.

But in reality, if you calculate the 15% GST on $127.25 it is exactly $19.09. Therefore, what we are currently displaying is correct even though it looks wrong.

If GST Rounding is causing an issue with "unpaid" amounts on invoices, entering prices as Price Incl GST will absorb the rounding within the total amount of the product and in most cases will stop the issue of small "unpaid" amounts displaying against a client.