This article describes the different types of Banking, Daily Takings, Held Accounts, and Reversed Payment and Bounced Cheque reports available in Bp Premier.

In this article:

Set up users to access reports

To access reports, you must have the Reports permission set to Allow access, and you must have reports set up via Setup > Users > Edit > Set Reports.

- From the Bp Premier home screen, select Management > Reports. The Bp Premier Reports screen will appear.

- Select the report you wish to view from the Available reports list. Depending on the report, the Choose the Report Parameters screen may appear.

- If the Choose the report Parameters screen appears, select your required report parameters from the Date, locations and Providers, Billing, Banking and Configuration tabs, and click View Report.

Banking (grouped by bank account)

This report lists all banking batches that have been banked during the selected date range.

The report is broken into two groups of columns: Account Type (such as Private, Medicare, DVA) and Payment Method (such as Cash, Cheque, EFT) with totals per group for each column.

.png)

Grouping

There is only one grouping option for this report on Bank account then Banking date.

Shading

|

Pink |

Banking batches that contain payments which have been adjusted or reversed are shaded in pink. The related payment is also shaded. |

Notes on usage

The report can be expanded down to the payment, invoice and service level.

A Deposit column has been included in the Account Type section to identify deposits and refunds, which are not related to a specific account type.

The report also shows Direct Credit amounts recorded in the system even though they are not part of a batch. These will be shown using the Payment date to best reflect when the money would have appeared on a bank statement.

Where the Direct Credit was generated from an Online Claiming batch, the provider number and payment run number will also be shown when the line is expanded.

Banking (grouped by bank account) using payment created date

This report lists all banking batches that have been banked during the selected date range.

The report is broken into two groups of columns: Account Type (such as Private, Medicare, DVA) and Payment Method (such as Cash, Cheque, EFT) with totals per group for each column.

UsingPaymentDate.png)

Grouping

There is only one grouping option for this report on Bank account then Banking date.

Shading

|

Pink |

Banking batches that contain payments which have been adjusted or reversed are shaded in pink. The related payment is also shaded. |

Notes on usage

The report can be expanded down to the payment, invoice and service level.

A Deposit column has been included in the Account Type section to identify deposits and refunds, which are not related to a specific account type.

The report also shows Direct Credit amounts recorded in the system even though they are not part of a batch. These will be shown using the Payment date to best reflect when the money would have appeared on a bank statement.

Where the Direct Credit was generated from an Online Claiming batch, the provider number and payment run number will also be shown when the line is expanded.

Banking (grouped by date)

This report lists all banking batches that have been banked during the selected date range.

The report is broken into two groups of columns: Account Type (such as Private, Medicare, DVA) and Payment Method (such as Cash, Cheque, EFT) with totals per group for each column.

.png)

Grouping

The report can be grouped by:

- Location - groups by Location > Bank Account > Banking Date

- User - groups by User > Bank Account > Banking Date

- User (Location) - groups by User > Bank Account > Banking Date

Shading

|

Pink |

Banking batches that contain payments which have been adjusted or reversed are shaded in pink. The related payment is also shaded. |

Notes on usage

The report can be expanded down to the payment, invoice and service level.

A Deposit column has been included in the Account Type section to identify deposits and refunds, which are not related to a specific account type.

The report also shows Direct Credit amounts recorded in the system even though they are not part of a batch. These will be shown using the Payment date to best reflect when the money would have appeared on a bank statement.

Where the Direct Credit was generated from an Online Claiming batch, the provider number and payment run number will also be shown when the line is expanded.

Banking (grouped by date) using payment created date

This report is identical to the Banking (grouped by Date) report, except that all Medicare / DVA direct credit payments use the payment created date instead of the payment run date.

Backdated transactions will be shown according to the date they were entered. Depending on how your practice reconciles payments and banking, you may find this report easier to use for reconciliation.

UsingPaymentCreatedDate.png)

Grouping

The report can be grouped by:

- Location - groups by Location > Bank Account > Banking date > Batch number

- User - groups by User > Bank Account > Banking Date

- User (Location) - User > Bank Account > Banking Date

Shading

|

Pink |

Banking batches that contain payments which have been adjusted or reversed are shaded in pink. The related payment is also shaded. |

Notes on usage

The report can be expanded down to the payment, invoice and service level.

A Deposit column has been included in the Account Type section to identify deposits and refunds, which are not related to a specific account type.

The report also shows Direct Credit amounts recorded in the system even though they are not part of a batch. These will be shown using the Payment date to best reflect when the money would have appeared on a bank statement.

Where the Direct Credit was generated from an Online Claiming batch, the provider number and payment run number will also be shown when the line is expanded.

Banking (grouped by provider)

This report lists all banking batches that have been banked during the selected date range.

The report is broken into two groups of columns: Account Type (such as Private, Medicare, DVA) and Payment Method (Cash, Cheque, EFT), with totals per group for each column.

.png)

Grouping

The report can be grouped by:

- Location - groups by Location > Bank Account > User

- User - groups by User > Bank Account > Banking Date

- User (Location) - User > Bank Account > Location

Shading

|

Pink |

Banking batches that contain payments which have been adjusted or reversed are shaded in pink. The related payment is also shaded. |

Notes on usage

The report can be expanded down to the payment, invoice and service level.

A Deposit column has been included in the Account Type section to identify deposits and refunds, which are not related to a specific account type.

The report also shows Direct Credit amounts recorded in the system even though they are not part of a batch. These will be shown using the Payment date to best reflect when the money would have appeared on a bank statement.

Where the Direct Credit was generated from an Online Claiming batch, the provider number and payment run number will also be shown when the line is expanded.

Banking (grouped by provider) using payment created date

This report is identical to the Banking (grouped by provider) report, except that all Medicare / DVA direct credit payments use the payment created date instead of the payment run date.

Backdated transactions will be shown according to the date they were entered. Depending on how your practice reconciles payments and banking, you may find this report easier to use for reconciliation.

UsingPaymentCreatedDate.png)

Grouping

The report can be grouped by:

- Location - groups by Location > Bank Account > Provider

- User - groups by Provider > Bank Account > Location

- User (Location) - Provider > Location > Bank Account

Shading

|

Pink |

Banking batches that contain payments which have been adjusted or reversed are shaded in pink. The related payment is also shaded. |

Notes on usage

The report can be expanded down to the payment, invoice and service level.

A Deposit column has been included in the Account Type section to identify deposits and refunds, which are not related to a specific account type.

The report also shows Direct Credit amounts recorded in the system even though they are not part of a batch. These will be shown using the Payment date to best reflect when the money would have appeared on a bank statement.

Where the Direct Credit was generated from an Online Claiming batch, the provider number and payment run number will also be shown when the line is expanded.

Banking Summary (grouped by provider)

This report provides a summary of banking batches created within a specific date range. It also includes direct credit and Medicare / DVA payments with payment dates within the same date range.

Batch totals are broken into columns by payment type (i.e. EFT, Cash, etc) and grouped by banking batch or payment date.

The report prints in portrait orientation and being a summary does not show any detailed payment or service lines.

.png)

Grouping

Default grouping for this report is by location then bank account then provider, however by changing the default report grouping on the configuration tab to 'User' the report will print a separate page per provider.

Shading

|

Pink |

Banking batches that contain payments which have been adjusted or reversed are shaded in pink. |

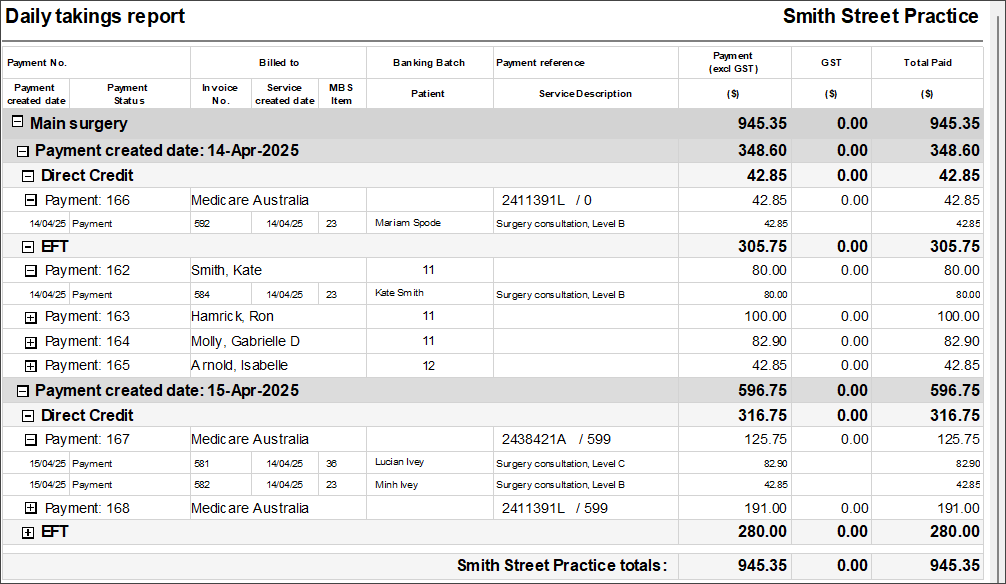

Daily takings

This report is in portrait format and lists all payments created within the specified date period.

This report can be used prior to creating a banking batch to ‘balance’ the various payment methods totals against EFT machine report, Cash drawer, Cheques held. Both normal payments and deposits are included in this report.

Grouping

Payment amounts are grouped by Payment method. Credit card payments are separated further to include the Credit card type.

This report groups only by payment method. Totals are provided for each payment method and can be further expanded to show details of each payment and service.

Shading

|

Pink |

Payments that were banked then reversed without a reversal credit or reversal credit/deposit that were banked then adjusted are highlighted Pink on this report and in the Banking Batch screen. These values will adversely affect the original banking batch totals as changes were made after banking. |

|

Green |

Payments that were banked and then reversed with a payment reversal credit are highlighted Green in this report and are highlighted Pink in the Banking Batch screen. These values will not affect the banking totals as credit exists against the patient's billing history. |

|

Blue |

Deposits that have been used, adjusted or refunded are highlighted Blue in this report and are highlighted Pink in the Banking Batch screen. These values will not affect the banking batch totals. |

Daily takings report by payment date

This report is identical to the Daily takings report, except that the report uses the payment date rather than the payment created date. Payments that are adjusted or backdated will show in the report range only if the payment date recorded by the operator is in the report range.

.png)

NOTE Because this report uses payment date rather than payment created date, the data reported will alter if new payments are entered with backdated payment dates or if a payment with a payment date in range is adjusted.

Grouping

Payment amounts are grouped by Payment method. Credit card payments are separated further to include the Credit card type.

This report groups only by payment method. Totals are provided for each payment method and can be further expanded to show details of each payment and service.

Shading

|

Yellow |

Payments that are backdated or adjusted after the payment date are highlighted in yellow. As this report uses payment date rather than payment created date, these payments will need to be taken into account when using a report printed retrospectively. |

|

Pink |

Payments that were banked then reversed without a reversal credit or reversal credit/deposit that were banked then adjusted are highlighted Pink on this report and in the Banking Batch screen. These values will adversely affect the original banking batch totals as changes were made after banking. |

|

Green |

Payments that were banked and then reversed with a payment reversal credit are highlighted Green in this report and are highlighted Pink in the Banking Batch screen. These values will not affect the banking totals as credit exists against the patient's billing history. |

|

Blue |

Deposits that have been used, adjusted or refunded are highlighted Blue in this report and are highlighted Pink in the Banking Batch screen. These values will not affect the banking batch totals. |

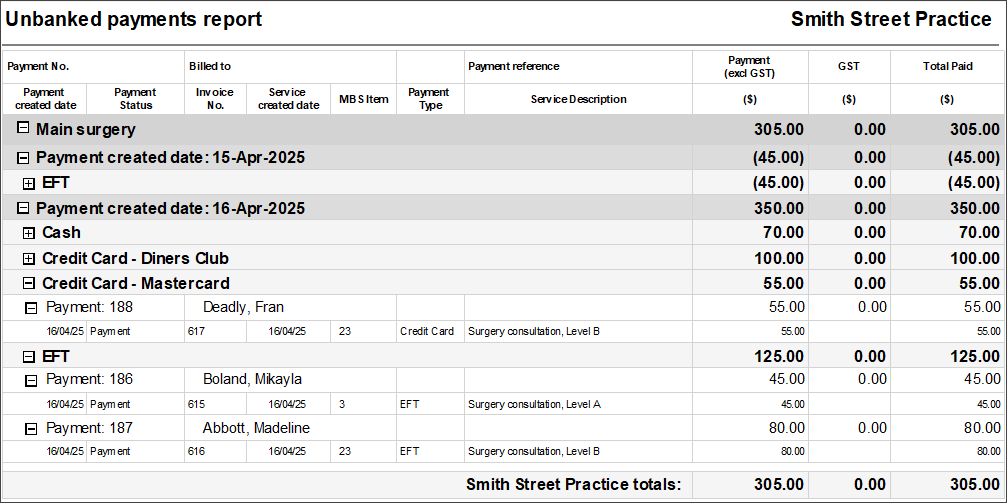

Unbanked payments

This report lists all payments that were created in the specified date range that are yet to be included in a Banking batch.

The report is very similar to the Daily Takings reports and can be used prior to the banking to 'balance' the various payment method totals against the EFT machine report, Cash drawer, Cheques held, etc.

It would be used in preference to the Daily Taking report when multiple banking batches are created during the day rather than one at the end of the day.

Notes on usage

Payments are included based on the location where the payment was taken and not the location where the service was performed.

Direct Credit payments are not shown on this report as they do not appear on the Banking Batch screen.

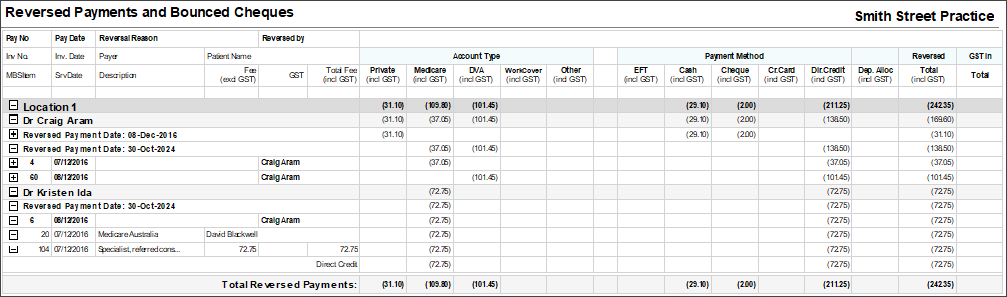

Reversed Payments and Bounced Cheques

This report will display all payments that have been reversed as well as any cheques that have been bounced within the selected date range. For each adjusted payment, both account Type and payment method are shown with payment value showing in the relevant column.

Grouping

The report is grouped by Location, Provider and Reversal date with a total for each group with the option to drill down to the service level if required.

Held Accounts by Account Type (grouped by service created)

This report returns all pending held accounts for the selected time period.

The Held Accounts report can assist a practice in tracking held account totals, and determining whether the held account total for a given time has risen or fallen beyond a practice ‘average’ or defined limits.

.png)

Grouping

Held accounts are grouped by service created date and show the patient and amount breakdown for the account.

Last updated: 16 April 2025.