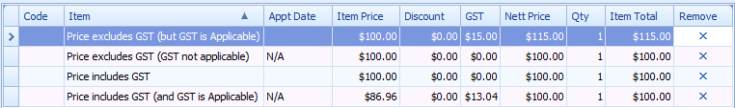

Below are some examples of how to set the different GST options and what information is displayed on an invoice. The amount of GST calculated is set in System > Options > Practice Information.

NOTE In versions prior to 3.7.7.5 setting both the GST Applicable and Price Incl. GST fields to Yes will not yield the result below. The GST amount will not be displayed separately.

|

Sell Price |

GST Applicable |

Price Incl GST |

Invoice Displays as

|

|---|---|---|---|

|

$100 |

|

|

|

|

$100 |

|

|

|

|

$100 |

|

|

|

|

$100 |

|

|

|

This is how the items are displayed within the Invoices Section of Bp Allied.

GST Rounding

TIP For items that are GST applicable but where the Item Price has been entered in exclusive of GST, the values displayed in an Invoice may be subject to rounding. Click here to see more information.

If GST Rounding is causing an issue with "unpaid" amounts on invoices, then entering prices as Price Incl GST will absorb the rounding within the total amount of the product and in most cases will stop the issue of small "unpaid" amounts displaying against a client.