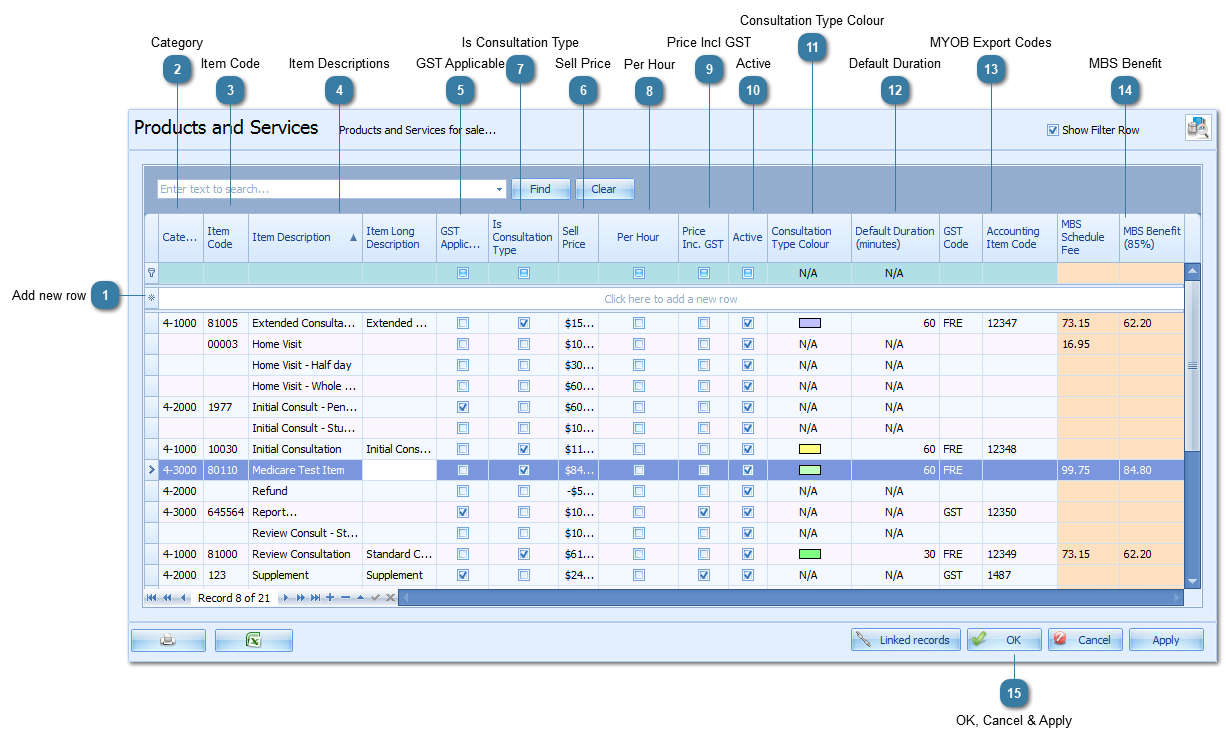

Adding a Product or Service

Add new rowClick in the Add new row field to add a new product or service

|

|

CategoryClick on the drop down to select a category

-

Use of this field is optional -

These are Product Categories specified in the Product Categories table. They are used to group Products or Services together when displayed in the Consultation drop down lists in an appointment.

|

|

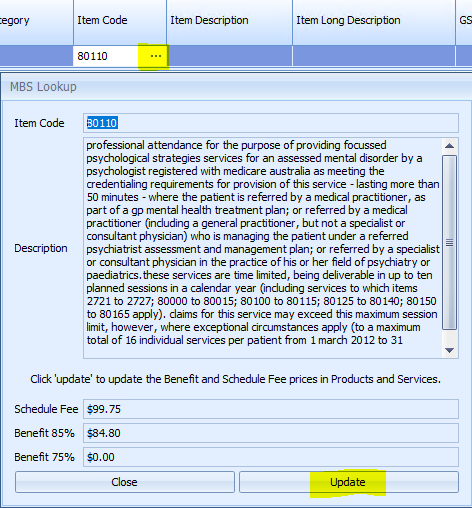

Item CodeType in the Item Code, if required

-

This is a short code that can be used to identify items. In particular, it is used to hold Medicare product or service item numbers which Medicare use as a basis for payment.

If a Medicare Item code is added in here the ... can be clicked on to view the MBS details.

Click Update to add the MBS Schedule Fee and MBS Benefit amount to the product record.

If these values need to be added to a number of items then use the option in Data Maintenance > MBS (Scheduled Fees) > Update Products & Services |

|

Item DescriptionsType in the item descriptions

-

-

This is the description of the product or service. -

This is used to select the Consultation Type for an appointment and is usually the description included on an invoice. -

It can be a maximum of 50 characters in length -

-

This is a more lengthy description of the product or service. -

It can also be used on an invoice. -

There is not limit to the number of characters used -

Use of this field is optional

|

|

GST ApplicableTick if the product or service needs to have GST calculated on the Sell Price.  In versions prior to 3.7.7.5 setting both the GST Applicable and Price Incl GST fields to Yes will not display the GST amount separately. |

|

Sell PriceType in the price of the item

-

The price of the product or service - whether this is includes or excludes GST depends on the GST options ticked.

|

|

Is Consultation TypeTick as required

For the purposes of Bp Allied the following definitions apply:

-

Is Consultation Type = True (is ticked) when it relates to the selling of services that take place at a specific time for which an appointment is made. -

Is Consultation Type = False (not ticked) when it is a Product is a physical item to be sold. This can be sold independent of an appointment; OR a service that does not relate to time.

If this is left ticked then when the item is added to an invoice a corresponding appointment will need to be selected |

|

Per HourTicked when the price entered is an hourly rate.

If an item is added to an Invoice that is designated per hour = True, then the duration of the appointment is calculated in hours and added to the invoice in the Qty field.

eg 1 hour appt = Qty 1; 1/2 hr appt = Qty 0.5

The price is then multiplied by that number of hours calculated for the appointment

|

|

Price Incl GSTTick if the Sell Price includes GST.  In versions prior to 3.7.7.5 setting both the GST Applicable and Price Incl GST fields to Yes will not display the GST amount separately. |

|

ActiveBy default the Active tick box is ticked

-

If it is no longer a current Product or Service then untick the Active tick box and the option will not display in any of the available drop down lists. -

|

|

Consultation Type ColourSelect the colour from the palette

-

This is the colour that an appointment will be displayed in the Appointment Book when the selected Consultation Type is chosen. -

If this is not selected then it displays as white -

The option Use Colours to display Consultation Types in Options > Appointment Book needs to be checked for the colours to be displayed.

|

|

Default DurationType in the duration, in minutes e.g. 30 for 30 minutes or 60 for a 1 hour appointment

The default duration for a Consultation Type.

-

Used when creating the appointment duration for the selected Consultation Type -

If this is not defined then the default duration for an appointment is the Default Appointment Duration set in Options > Appointment Book

|

|

MYOB Export CodesThese two columns have been added so that when sales information is exported to MYOB the records can be matched using the Accounting Item Code. Any products or services without having one of these assigned will not be imported. See more details on the MYOB export report. |

|

MBS BenefitIf a Product or Service has a relevant Item Code, then when the MBS Scheduled fees are imported into Products and Services, the relevant fee will show in these fields. These will be used by Medicare Online Claiming. |

|

OK, Cancel & ApplyClick OK to save changes and to close the options window.

Click Cancel to disregard changes and close the options window.

Click Apply to save the changes and keep the options window open.

|

|