Using the Item Sales Report

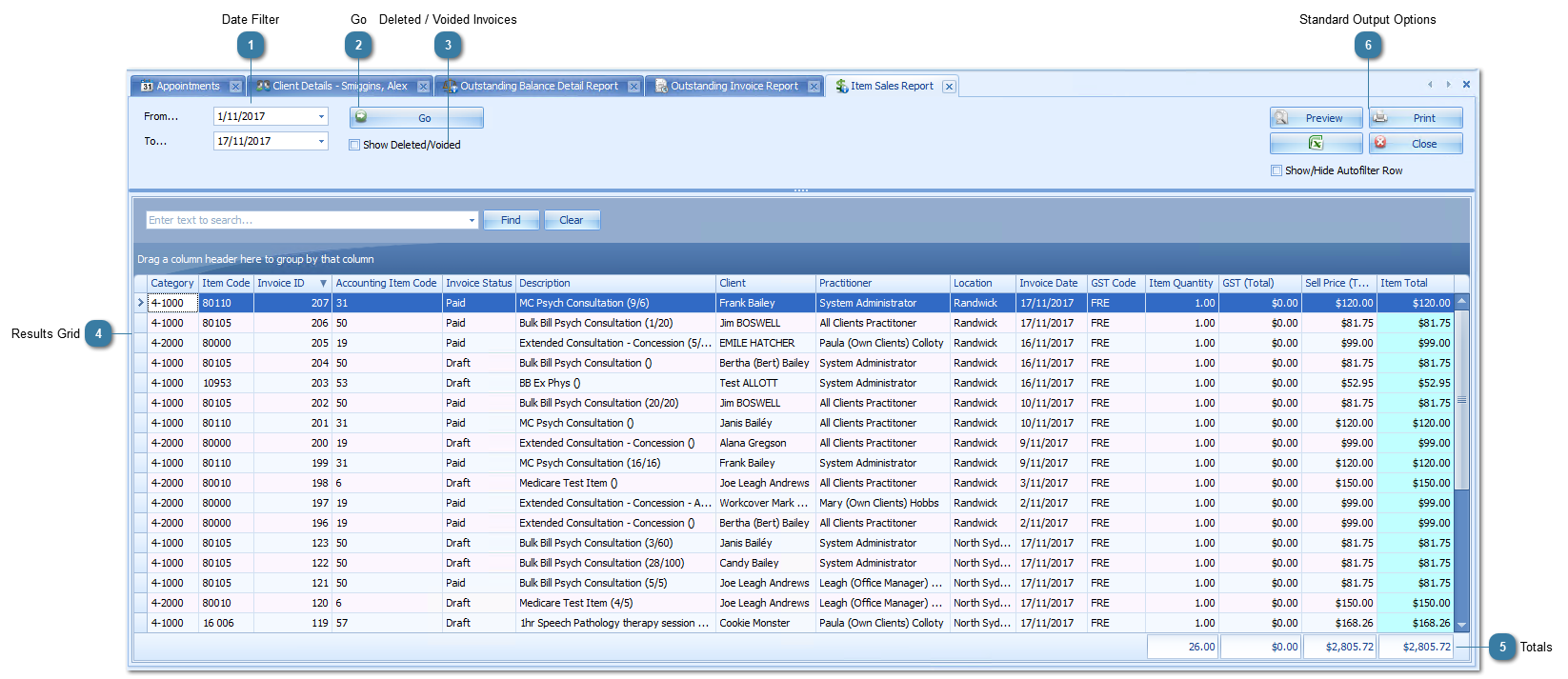

This report displays the individual items that are included in all invoices for the dates selected. Each items from the same invoice will be shown on separate lines. Grouping by Invoice ID will allow all items in the one invoice to be displayed together. For detailed information on using the Filtering, Grouping and other manipulations of the views please refer to the linked articles.

|

By default any deleted or voided invoices are not included in the results grid. Turn this on to display invoices of these statuses.

|

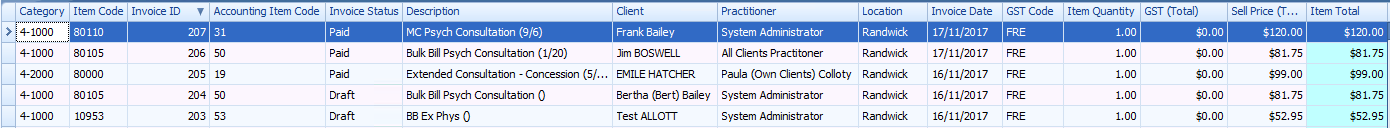

Item Code - This is a short code that can be used to identify items. In particular, it is used to hold Medicare product or service item numbers which Medicare use as a basis for payment.

Invoice ID - Links to the related invoice. If clicked the invoice displays in the Invoice module.

Accounting Item Code - A unique number to individually identify each product or service - used for the export into MYOB

Invoice Status - E.g. Paid or Awaiting Payment. Based on the statuses available that can be reviewed here.

Description - Item Description as per Products and Services.

Client - Client that the item was created for

Practitioner - Name of the Practitioner on the invoice. If there are multiple clients / appointments on the invoice then this will be the Practitioner for the first appointment invoiced.

Location - Name of the location on the invoice. If there are multiple clients / appointments on the invoice then this will be the location for the first appointment invoiced.

Invoice Date - Date of the invoice

Item Quantity - Number of the items charged for

GST (Total) - Amount of GST incurred per item

Sell Price (Total) - The price of the product or service

Item Total - Total price of the product or service including any GST or discounts and quantity variations as applicable.

|

|

The built in totalling function shows the totals of each column.

Details on how to add or change totals can be found here.

|

Use the standard options to Export, Preview or Print the report.

|