The Assistants fee rule has been added for use when setting up charging for the following assistance-related items: 51300, 51303, 51306, 51309, 51312, 51315, 51318, 25200, 25205, 51800, and 51803.

To correctly apply assistance fee calculation when billing these items, you must make the following changes in Setup > Charges:

- apply the assistants fee rule to the item codes

- set the assistants fee multiplier for any health fund fee scalers

- set the assistants fee multiplier for any private or non-health-fund fee scalers.

If the subsidiser for an invoice with asssistant fee items is DVA or DVA Hospital, Bp VIP.net will apply logic to ensure that the claim must be sent from the Billing window (F5) and not the Payments or Transactions windows.

Assistance item code descriptions

|

Item |

Description |

|---|---|

|

51300 |

Assistance at any operation identified by the word "Assist." for which the fee does not exceed a specified amount or at a series or combination of operations identified by the word "Assist." where the fee for the series or combination of operations identified by the word "Assist." does NOT exceed the specified amount. This is not a calculated rate. When a 51300 item is selected, the value is determined through the fee scaler or subsidiser’s setup fee. |

|

51303 |

Assistance at any operation identified by the word "Assist." for which the fee exceeds the specified amount or at a series of operations identified by the word "Assist." for which the aggregate fee exceeds the specified amount. One fifth of the established fee for the operation or combination of operations. This means Medicare benefits are payable under item 51303 for assistance for any operation identified by the word "Assist." for which the fee exceeds the amount specified in the item descriptor or a series or combination of operations identified by the word "Assist." for which the entire Schedule fee exceeds the specified amount. |

|

51306 |

Assistance at a delivery involving Caesarean section |

|

51309 |

Assistance at a series or combination of operations which have been identified by the word "Assist." and assistance at a delivery involving Caesarean section. One fifth of the established fee for the operation or combination of operations (the fee for item 16520 being the Schedule fee for the Caesarean section component in the calculation of the established fee). |

|

51312 |

Assistance at any interventional obstetric procedure covered by items 16606, 16609, 16612, 16615, 16627, and 16633. One fifth of the established fee for the procedure or combination of procedures. |

|

51315 |

Assistance at cataract and intraocular lens surgery covered by item 42698, 42701, 42702, 42704, or 42707, when performed in association with services covered by item 42551 to 42569, 42653, 42656, 42725, 42746, 42749, 42752, 42776, or 42779. |

|

51318 |

Assistance at cataract and intraocular lens surgery where patient has:

|

Assistance at multiple operations

Where surgical assistance is provided at two or more operations performed on a patient on the one occasion, the multiple operation formula is applied to all the operations to determine the surgeon's fee for Medicare benefits purposes. The multiple operation formula is then applied to those items at which assistance was given and for which Medicare benefits for surgical assistance is payable to determine the abated fee level for assistance. The abated fee is used to determine the appropriate Schedule item covering the surgical assistance (that is, either item 51300 or 51303).

The following table provides the multiple operation rule for assistants available in Bp VIP.net version 514 and later.

|

Multiple operation rule (surgeon) |

Multiple operation rule (assistant) |

|---|---|

|

Item A - $300@100% |

Item A (Assist.) - $300@100% |

|

Item B - $250@50% |

Item B (No Assist.) |

|

Item C - $200@25% |

Item C (Assist.) - $200@50% |

|

Item D - $150@25% |

Item D (Assist.) - $150@25% |

The derived fee applicable to item 51303 is calculated on the basis of one-fifth of the abated Schedule fee for the surgery which attracts an assistance rebate.

Add the rule to the item codes

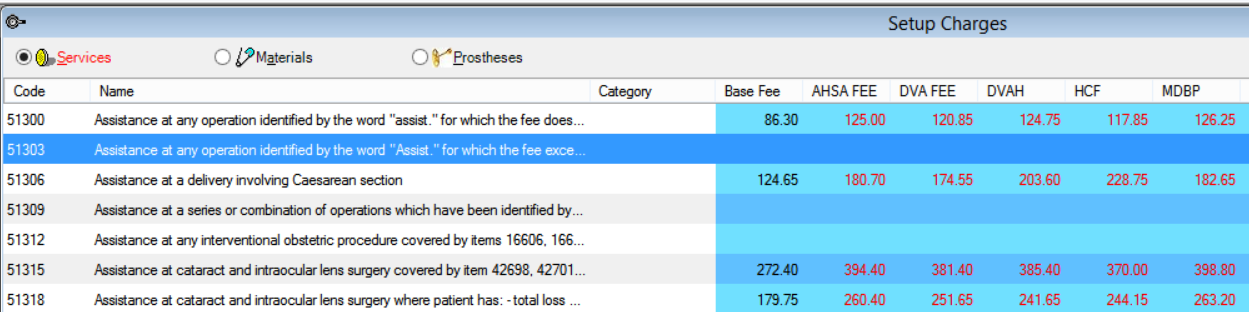

- Select Setup > Charges. The Setup Charges screen will appear.

- Scroll to the Code '51300', or click the Find button at the bottom of the screen and search for '51300'.

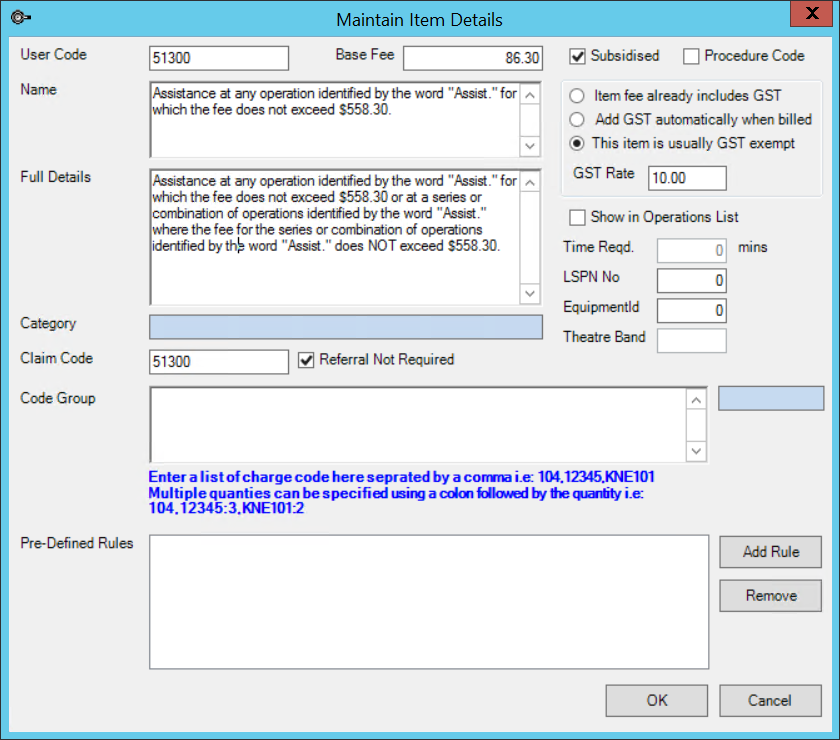

- Double-click '51300' in the Code column. The Maintain Item Details screen for item 51300 will appear.

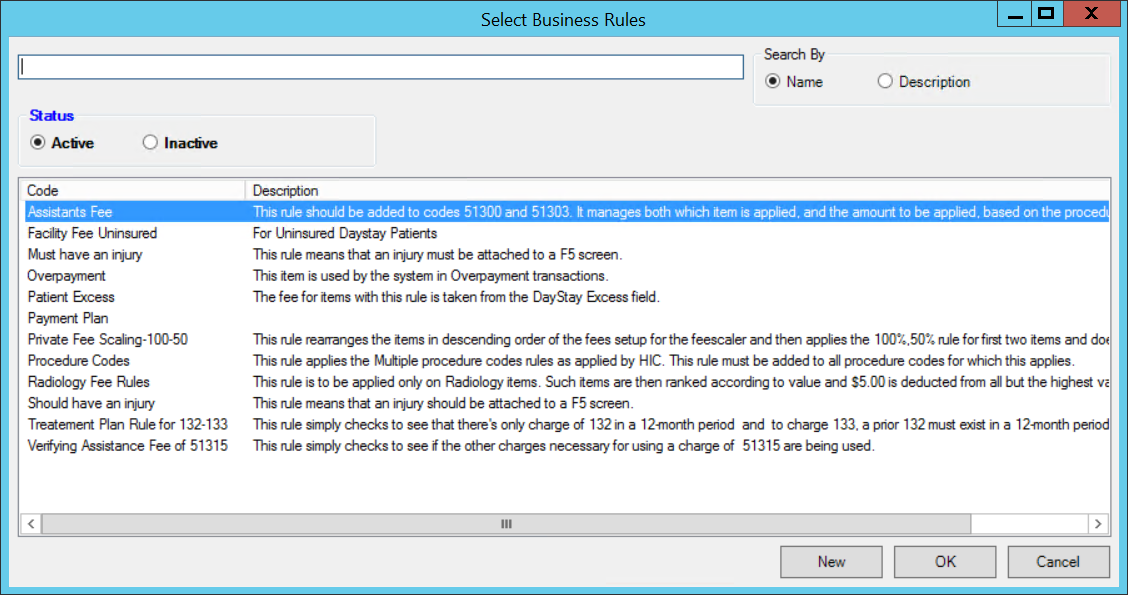

- Click Add Rule. The Select Business Rules screen will appear.

- Select the 'Assistants Fee' rule. Use the Search field to search for the rule if you need to.

- Click OK to return to the Maintain Item Details screen. Click OK to save the item code.

- Repeats steps 2–9 for the codes 51303, 51306, 51309, 51312, 51315, and 51318.

Set up the assistance fee for health funds

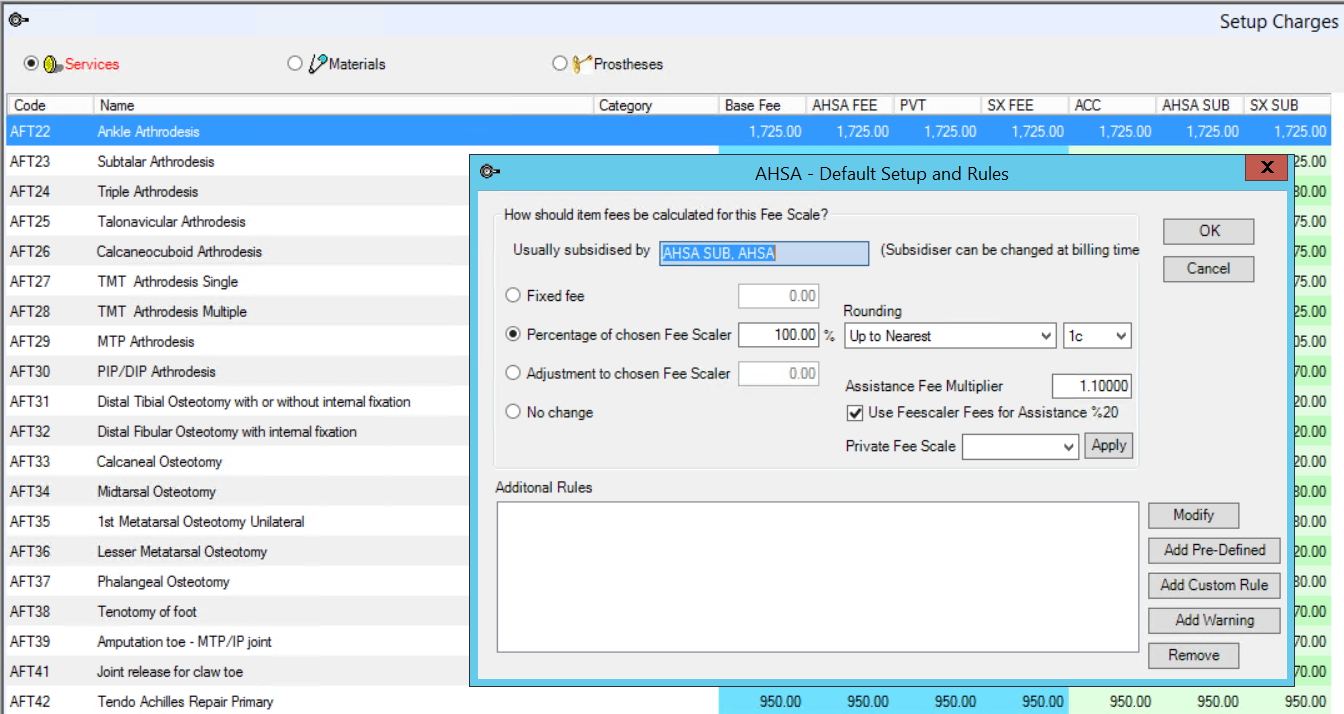

The following example shows how to set the Assistance Fee Multiplier for the health fund 'AHSA'.

- Select Setup > Charges. The Setup Charges screen will appear.

- Double-click on the 'AHSA' column header. The Default Setup and Rules screen will appear.

- Set the Assistance Fee Multiplier to the value supplied to you by your agreement with the health fund.

- Tick Use Feescaler Fees for Assistance %20.

- Leave Private Fee Scale untouched.

- Click OK.

- Repeat for all health funds at your practice to which assistance fees are chargeable.

NOTE In this example, the column header is 'AHSA FEE' to distinguish that the organisation is a fee scaler.

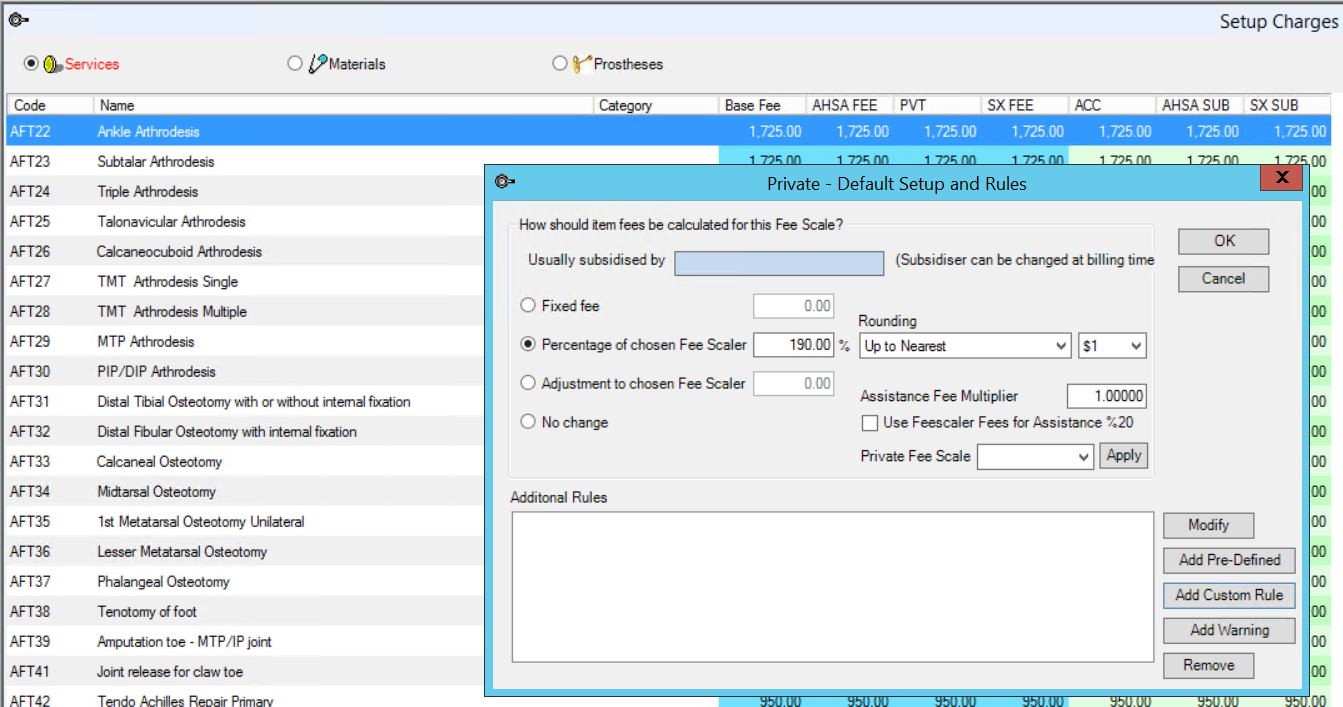

Set up the assistance fee for private charging

- Select Setup > Charges. The Setup Charges screen will appear.

- Double-click on the private schedule you want to set up in the column header. The Default Setup and Rules screen will appear.

- In this example, the column header 'PVT' is clicked to edit the practice's private fee scale. You could also have a fee scaler called 'Pension Fee', for example, if your practice offered a private fee scale for pensioner patients.

- Set the Assistance Fee Multiplier to '1.0'.

- Do not tick Use Feescaler Fees for Assistance %20.

- Set the Private Fee Scale to the ratio for this fee scale.

- Click OK.

- Repeat for all private fee scalers.

Related topics

Last modified: October 2021