On this page

The MYOB Export is enabled via an API that allows Bp Allied to talk directly to MYOB. The version of MYOB that was created with is AccountRight AU 2016.2.2 version 2016.2.18.5016.

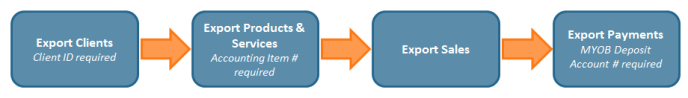

There are four different MYOB exports from Bp Allied that need to be carried out if MYOB is going to be used as your primary accounting package and it is reliant on information coming from Bp Allied. These exports need to be carried out in a particular order and imported into MYOB in that same order so that the information will match correctly. Prior to carrying out the exports there is some information that needs to be set-up in Bp Allied. This is detailed below. This will need to be checked prior to each set of exports as thing may have changed in your database between now and the time the previous exports were carried out.

Order to export (and then import) data in:

Before you start

IMPORTANT Please ensure that you back up your MYOB files prior to exporting the information from Bp Allied.

The MYOB Add-On Connector must be started to be able to connect to the MYOB file and for the exports to work.

Date Formats - these can affect the ability to import.

MYOB have not defined what the import date format has to be. The MYOB docs state that the date field should be in the format defined by the Users computer (regional settings). What this is displayed in the field below in the export.

![]()

Set up and export Clients

Allocate a Client ID to all clients

The import sets the Bp Allied Client ID as the Card ID in MYOB. Clients without Clients ID's assigned will not be imported.

This step needs to be carried out prior to each import of Sales and Payments under the assumption that your practice continually gets new clients.

- To allocate Client ID's to all clients without one go to Options > Client Details > Allocate Client ID's. Any matching records will be updated and any clients that do not exist will be created.

- Third Parties also require a Client ID and the only way this can be allocated is via the option above.

Set up Third Party Billers

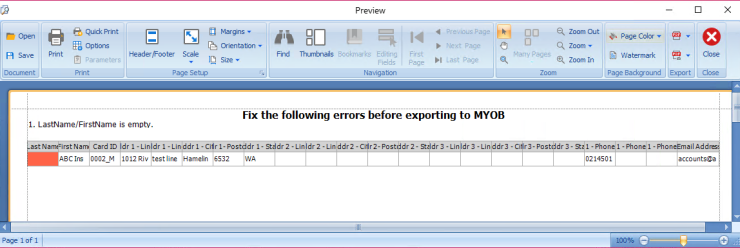

Ensure all Third Party Billers have both the Organisation/Last name and Attention/First name field filled in. Both fields are required to be able to export to MYOB.

Selecting the Preview Error Report button from the bottom of the MYOB Exports Reports screen will display any records that do not meet the appropriate criteria.

![]()

This report can be printed or saved.

Clients can now be exported.

Export clients

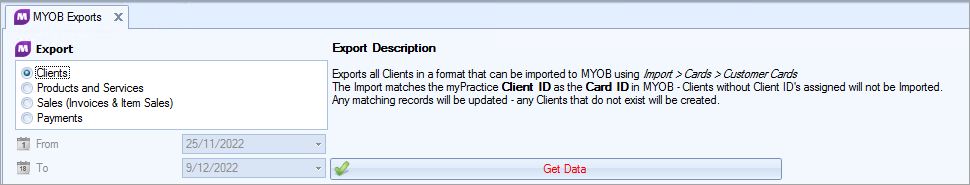

- Go to the Reports > Financial Exports.

- Select MYOB Exports.

- Select Clients.

- Select Records to Export.

- All clients or only New clients are to be exported? Choose All, if updates to addresses or other contact details need to be updated in MYOB.

- Click Get Data.

- Click Export to MYOB.

- Check the data in MYOB before proceeding.

NOTE Review the MYOB Export Known Issues when troubleshooting any errors that may occur.

Set up and export Products and Services

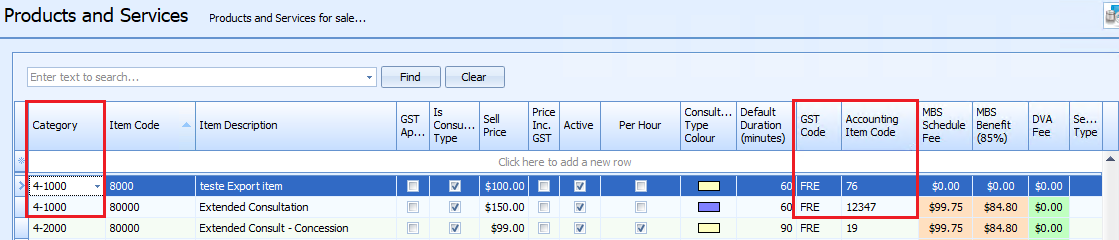

Enter the Accounting Item Code, Product Category and GST Codes into Products and Services

All Products or Services in Bp Allied must have a Category, Accounting Item Code and a GST Code assigned. If these fields are not populated in the Product or Service Details they will not be imported into the MYOB Export. If new Products or Services have been entered or prices have been changed, they will need to be imported prior to the export of Sales and Payment information.

|

Bp Allied field |

MYOB Field |

Data Type |

|---|---|---|

|

Item Number |

A unique number to individually identify each product or service. Type in a unique number for each line. |

|

|

Category |

Income Account |

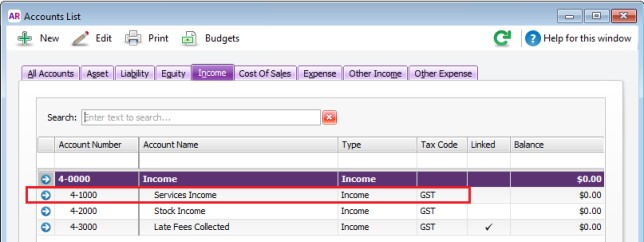

The MYOB Account Number is the account that Sales are recorded against. The Income Account value can be found in MYOB. In MYOB AccountRight Basics AU Version 2016.2.2, this can be found in Lists > Accounts > Income, e.g. 4-1000 in the image below.

|

|

GST Code |

Tax Code |

A GST Code must also be entered before any sales can be exported. This is the Tax Code field in MYOB that states whether an account is taxable or not. In the example above for the Account Numbers 4-1000 the Tax Code is GST.

|

Export Products and Services

- Go to the Reports > Financial Exports.

- Select MYOB Exports.

- Select Products and Services.

- Select Records to Export.

- All or New? Choose All if there have been price updates or description changes to be uploaded to MYOB.

- Click Get Data.

- Review data (see box below).

- Click Export to MYOB.

- Check the data in MYOB before proceeding.

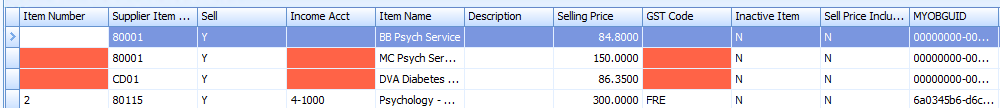

Review Products and Services

When running the Export > Products and Services any product missing an Accounting Item code will show up red in the Item Number field.

Clicking Preview Error Report will display any that do not meet the appropriate criteria.

![]()

This report can be printed or saved. Go back to the previous step to remedy these and then re-run the export.

Review and export invoices

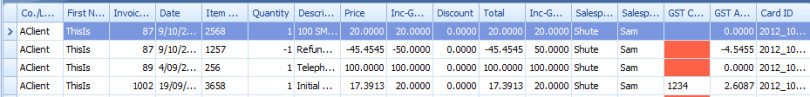

Review Invoices and Item Sales

The Bp Allied Client ID and MYOB Customer Card ID are used to match the imported information and associate it to the correct client. Invoices are created or updated based on the Invoice Number. All Products and Services (Items in MYOB) and Clients (Customer Cards in MYOB) must be imported/created prior to Importing Sales. Invoices that have already been exported are not re-exported to MYOB. When a record is exported, the MYOBGUID field is filled in by MYOB and hence any record with this value will not be exported again.

As this exports the User (Practitioner) Name and ID for each line into the Employee information in MYOB these need to match. The MYOB export from Bp Allied will update the MYOB Employee name with the one in Bp Allied if they do not match.

Review Invoices

If there are missing GST Codes or Accounting Items numbers, the missing information will be highlighted in red on the report. This information must be corrected prior to the export.

- Update the Accounting Item Number and GST Codes for any Products or Services missing them.

-

Selecting the Preview Error Report button from the bottom of the MYOB Exports Reports screen will display any records that do not meet the appropriate criteria.

![]()

This report can be printed or saved.

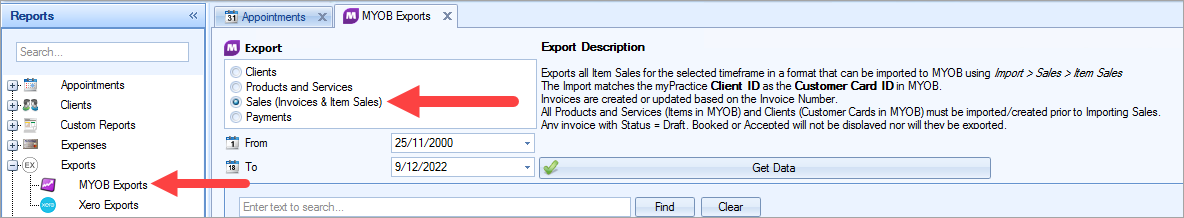

Export Sales

Exports all sales for the selected time frame and directly imports into MYOB.

TIP Please ensure that the time frame selected lies within the financial year of the MYOB file exporting into.

- Go to the Reports tab.

- Select Exports > MYOB Exports.

- Select Sales (Invoices and Item Sales.

- Enter the From and To Date Range in the drop-down fields (note that this can only be related to the financial period included in the MYOB file).

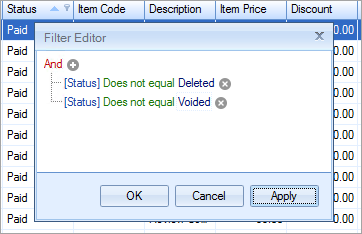

- Remove Voided and Deleted invoices from the list by right-clicking on the Invoice Status column heading to use the Filter Editor if required.

- Click Get Data.

- Click Export to MYOB.

- Check the data in MYOB before proceeding.

NOTE All or New Records to Export will not apply the selected filters. Only invoices that have not been exported will be exported to MYOB. For more information on using the Filter Editor see the Filter a view or report.

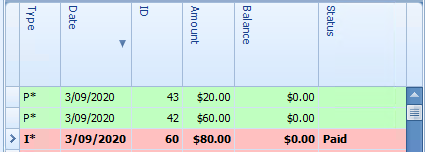

When looking in the Transactions grid in the Invoices section, any Invoice, Payment or Refund with an * after the Type letter means that it has been exported to MYOB (or Xero).

Set up and export payments

Set up payments and MYOB deposit account

The Bp Allied Client ID and MYOB Customer Card ID are used to match the imported information and associate it to the correct client. To be able to match the Payments against Sales automatically in MYOB, Sales must be exported from Bp Allied and imported into MYOB before the payments are imported. Matching Clients, products and payment methods must also exist.

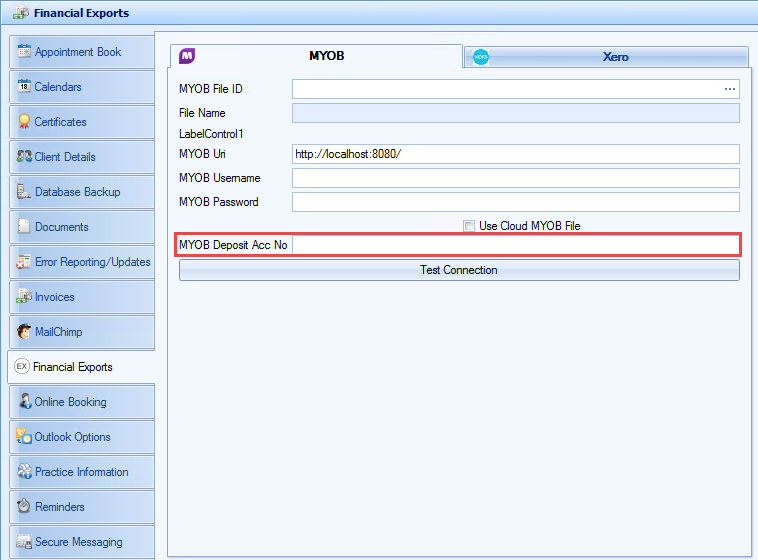

The MYOB Deposit Account Number is required to enable the export of payments.

-

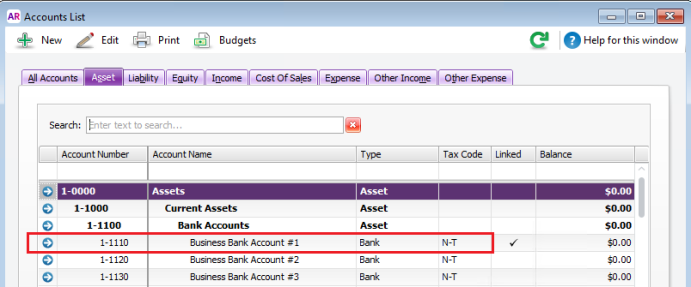

In MYOB AccountRight Basics AU Version 2014.3.16.5484, locate the Account Number from Accounts > Accounts List > Assets.

-

Enter the MYOB Deposit Account Number into Option > Financial Exports in Bp Allied. This will allow payments to be entered against the correct account in MYOB.

Export payments

This tool exports all payments and refunds for the selected time-frame and directly imports into MYOB. Payments that have already been exported are not re-exported to MYOB. When a record is exported the MYOBGUID field is filled in by MYOB and hence any record with this value will not be exported again.

TIP Please ensure that the time-frame selected lies within the financial year of the MYOB file that the payments are exported into.

- Go to the Reports tab > Select Exports.

- Select MYOB Exports.

- Select Payments.

- Select the Date Range.

- Click Get Data.

- Filter out the refunds from the Transaction Type field if required.

- Click Export to MYOB.

- Check the data in MYOB.