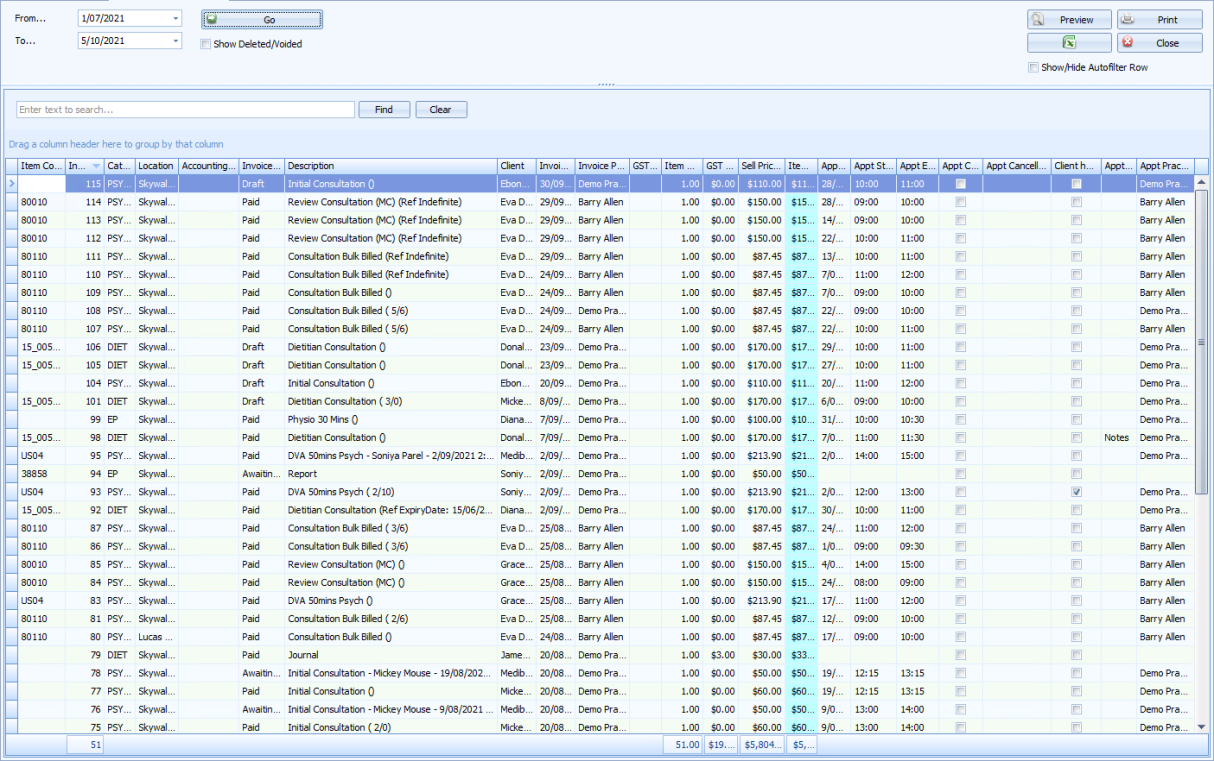

This report displays the individual items that are included in all invoices for the dates selected. Each item from the same invoice will be shown on separate lines. Grouping by Invoice ID will allow all items in one invoice to be displayed together. For detailed information on using the Filtering, Grouping and other manipulations of the views please refer to the linked articles.

|

Field |

Description |

|---|---|

|

Date Filter |

Used to filter the dates displayed. The results are inclusive of the dates selected. |

|

Go |

Click Go to display the items based on the date and filter selection. |

|

Deleted/Voided Invoices |

By default any deleted or voided invoices are not included in the results grid. Turn this on to display invoices of these statuses. |

|

Totals |

The built in totalling function shows the totals of each column. Details on how to add or change totals can be found here. |

|

Standard Output Options |

Use the standard options to Export, Preview or Print the report. |

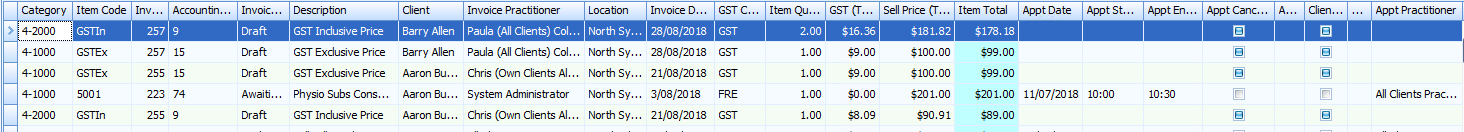

Results Grid

Category - The MYOB Account Number is the account that Sales are recorded against.

Item Code - This is a short code that can be used to identify items. In particular, it is used to hold Medicare product or service item numbers which Medicare use as a basis for payment.

Invoice ID - Links to the related invoice. If clicked the invoice displays in the Invoice module.

Accounting Item Code - A unique number to individually identify each product or service - used for the export into MYOB.

Invoice Status - E.g. Paid or Awaiting Payment. Based on the statuses available that can be reviewed here.

Description - Item Description as per Products and Services.

Client - Client that the item was created for.

Practitioner - Name of the Practitioner on the invoice. If there are multiple clients/appointments on the invoice then this will be the Practitioner for the first appointment invoiced.

Location - Name of the location on the invoice. If there are multiple clients/appointments on the invoice then this will be the location for the first appointment invoiced.

Invoice Date - Date of the invoice.

GST Code - GST Code as defined for the item export to MYOB or NDIS.

Item Quantity - Number of the items charged for.

GST (Total) - Amount of GST incurred per item.

Sell Price (Total) - The price of the product or service.

Item Total - Total price of the product or service including any GST or discounts and quantity variations as applicable.

For items that are related to an invoice the following additional fields are available:

Appointment Date – Date of the appointment that was invoiced.

Appointment Start Time – Start time of the appointment that was invoiced.

Appointment End Time – End time of the appointment that was invoiced.

Appointment Cancelled – Indicates if the appointment invoiced was cancelled.

Appointment Cancellation Reason – Indicates the reason for the cancellation (if entered).

Client has arrived – Indicates if the Client has arrived flag was set against the appointment.

Appointment Notes – displays any notes entered into the appointment.

Appointment Practitioner – The practitioner that the appointment was with. This could be different to the Invoice Practitioner if multiple clients have had appointments invoiced against the one invoice, or the practitioner has been purposely changed.