A cheque that has been deposited to the practice's bank account may 'bounce', or have insufficient funds available. Bounced cheques need to be recorded so that the billing history shows that the patient or account holder now owes money to the practice.

Bounced cheques are recorded from the Patient Billing History or Account Holder History screen.

If the cheque payment has not been included in a banking batch, you should adjust the payment just like any other payment that needs to be corrected. See Correct an unpaid account for more information.

If the cheque payment has been banked (that is, included in a banking batch), follow the steps below:

- Open the Patient Billing History or Account Holder History screen for the patient or account holder that paid with the bounced cheque.

- Tick the Show payments / deposits checkbox.

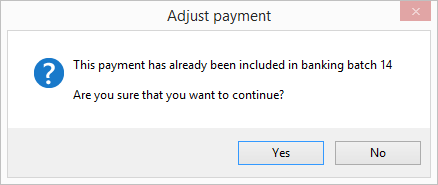

- Select the payment that the bounced cheque is for and click Adjust. A message will appear to indicate which batch the cheque was included in.

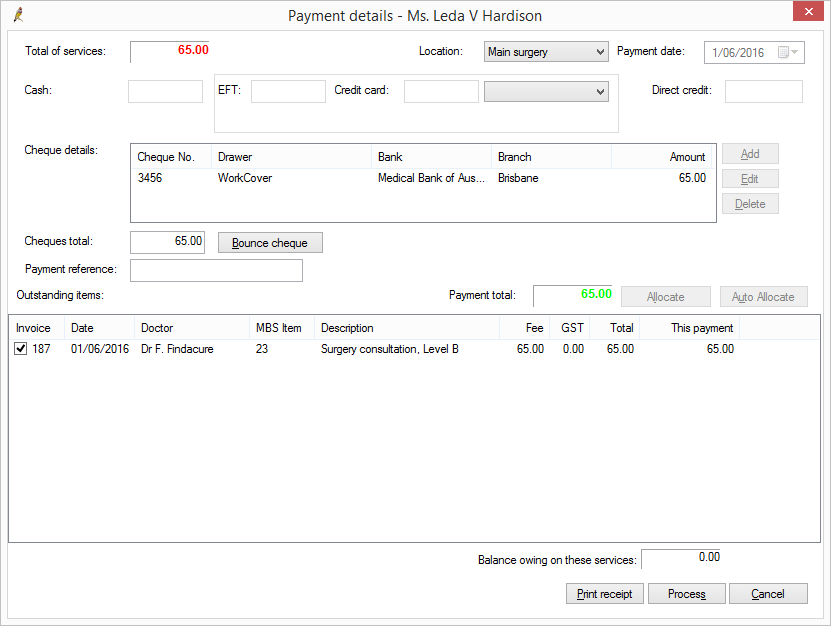

- Click Yes. The Payment details screen will appear.

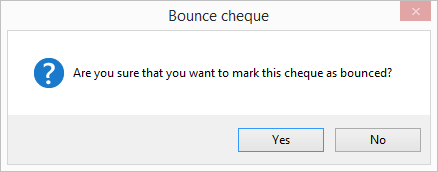

- Select the cheque in the Cheque details list and click Bounce cheque. Bp Premier will prompt you to confirm to mark the cheque as bounced.

- Click Yes. The cheque will be marked with '(bounced)', the value of Cheques total will change to $0.00, and the invoices that were paid by this cheque will be unticked.

- Click Process. The payment will disappear from the Patient Billing history screen.

- If you tick Include adjustments, a negative adjustment will be recorded for this payment. Any invoices that had been paid by the cheque will be marked as 'unpaid' and the amount owing at the top of the Patient Billing history screen will reflect this.