This article provides some questions and answers Bp Premier users might have about the Medicare Refunds function introduced in version Saffron and expanded on in Saffron SP1, and explains how the refund appears in the Billing History and reports.

Do I need to manually adjust my payments to providers?

You do not need to manually adjust any payments to doctors. The refund to Medicare will be deducted automatically in all payments, services, and transactions reports.

For example, if a service is paid and refunded in the same reporting period, the provider will not be paid for the service. If a service is paid in one reporting period and the service is refunded in the next, the service amount will be deducted in the second reporting period.

How does a Medicare Refund show in reports?

Reports will show the service as ‘Written off’ and payment adjustments with a status of Medicare or DVA refund, making it easier to identify changes to doctor payments.

How does a Medicare Refund affect banking reconciliation?

The method your practices uses determines how the refund is handled when reconciling banking:

- A 'cheque' refund will show in banking batches as a debit, and will balance the credit created by the payment reversal.

- A 'direct credit' refund will not show in banking batches, like any direct credit. However, in banking reports, the direct credit refund to Medicare will be shown, to balance the payment reversal amount.

How does a Medicare Refund show in the Billing History?

Bp Premier will automatically create service and payment adjustments in the Billing History:

- The Billing History screens will show the service with a status of ‘Written off’.

- The service adjustment will have a description of ‘Voided Service’ for full refunds, or 'Partial Refund Service' for partial refunds.

- A payment reversal will be created with a corresponding credit amount.

- A refund will be created to indicate that the payment reversal credit was refunded to Medicare.

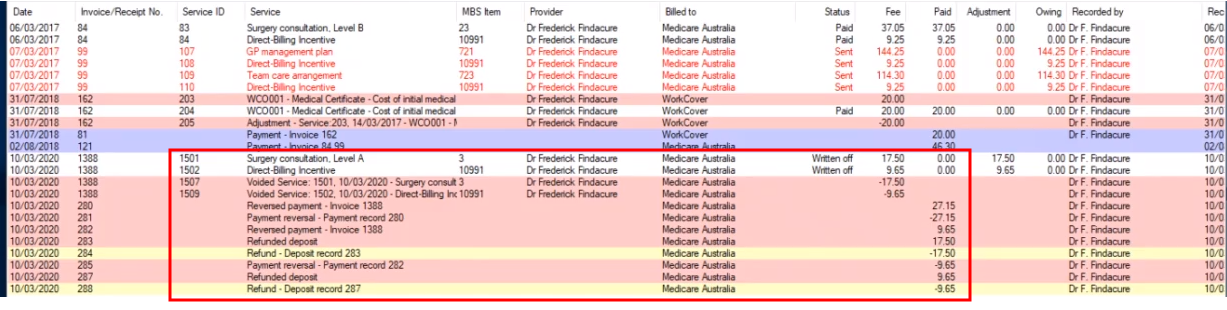

In the example below, two services (1501, 1502) were refunded from a single invoice (1388). No other services were on this invoice. 1501 was refunded first, then 1502.

- Both services were updated to 'Written off'.

- The description for both services indicates that they were voided (refunded through Medicare Refunds).

- A reverse payment record was created for the entire invoice, and service 1502 ($9.65) was repaid automatically from this invoice (see the next FAQ).

- A payment reversal and refund deposit were created for 1501.

- A payment reversal and refund deposit were created for 1502.

What happens to the other services in the same invoice?

In the previous example, service 1502 was automatically repaid after the first service in the invoice was refunded. Services are refunded one at a time; if there are other paid services on the same invoice, they will have a negative and positive payment adjustment created for them to keep the system in balance.

In the Billing History, Bp Premier will perform the following transactions (shown if Show payments/deposits is ticked):

- All services in the invoice will have their payments reversed.

- Payments for all services except for the refunded service will be recreated.

- In the example, the payment for the invoice 1388 totalled $27.15 being for both services 1501 ($17.50) and 1502 ($9.65). When item 1501 is refunded the system will create a negative adjustment to reverse the entire payment $27.15 and then a positive payment of $9.65, as this service has not been refunded yet.

Does this affect the payment date for those services?

Yes. The services in the invoice that were not refunded will now have a new payment date that is the date that the refund was processed through Medicare Refunds.

However, you do not need to perform any manual corrections in Bp Premier to account for this, because there is both a negative and positive adjustment record for the service that was not refunded. 'Payment created date' reports are not be affected by changes to payment dates.

Can I refund a Medicare overpayment or underpayment?

Yes. It doesn't matter whether Medicare overpaid, underpaid, or paid the claimed amount. The only restriction in Saffron is that you can only refund the entire amount paid.

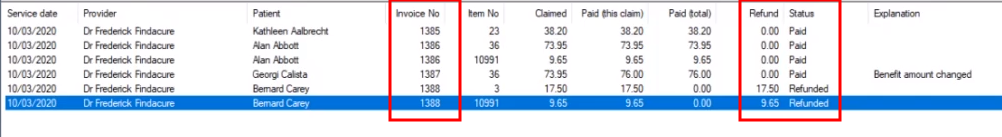

How do I tell in Online Claiming if a service was refunded?

After a service has been refunded to Medicare, its Status will change to 'Refunded'. The bottom half of the Online Claiming screen now includes two new columns: a Refund column to show the amount refunded to Medicare, and an Invoice No column to assist tracing the service back to the original invoice.

Last updated 30 April 2021